Author: Lance

Medicare Advantage Funding and the Causes of Non-Renewal Notices

by Lance D. Reedy

by Lance D. Reedy

For those of you that have received a non-renewal notice from your Medicare advantage company, we encourage you to review our companion article, I Received a Disenrollment Letter: What Now? It will explain your choices.

Note: In the discussion that follows, I have simplified some concepts for brevity.

History

The concept of Medicare Advantage (MA) plans began with the 1982 Tax Equity and Fiscal Responsibility Act (TEFRA). This act allowed privatized Health Maintenance Organization (HMO) plans to contract with Medicare to deliver a form of privatized Medicare. Health insurance companies later exited this privatized Medicare marketplace because the funding from Medicare wasn’t keeping up with rising costs.

The Balanced Budget Act of 1997 established the Medicare+Choice program. This was renamed Medicare Advantage by one of the provisions of the 2003 Medicare Modernization Act (MMA). It was this act that also stepped up the controversial capitation rate for the MA plans.

Medicare Advantage Funding

MA plans are privatized in that Medicare sends a certain amount of money per person per month to the sponsor, usually a large health insurance company, of the MA plan. This is called the capitation rate. This means that, for example, the base rate that the MA plan sponsor receives from Medicare is about $700 per month for every member enrolled in the sponsor’s plan. Simply put, they get so much per head per month. That’s the capitation rate.

Example: Betty Smith enrolls in the Medicare Deluxe plan from Acme Insurance Co. Her premium is $65 per month. Her plan also includes prescription coverage. Here is the revenue that Acme receives for enrolling Betty as a member:

Medicare Funding for the MA health plan: $700 per month (Note: this can be much higher for people with more health issues.), Medicare Funding for a prescription plan: $53 per month, Betty’s Premium: $65 per month. The breakdown is as follows: $30 is her contribution to the health plan, and $35 is for her prescription part of the plan.

Total: $818 per month

Remember, These Plans are Privatized

Let’s say that Betty has a knee replacement surgery with a total bill of $30,000. Her hospital stay is for three days. Her plan has a hospital copay of $300 per day with a five-day cap. Acme pays for all days that exceed five.

Here’s how it looks:

Total bill: $30,000

Betty pays $300 per day x 3 days or $900 to the hospital. The hospital bills the balance of $29,100 to Acme, not Medicare. Remember, as far as claims go, Medicare is out of the picture.

Let’s say the Betty had physical therapy after her surgery, some labs, doctor visits and other miscellaneous medical events that cost Acme an additional $4,000 during the course of the year.

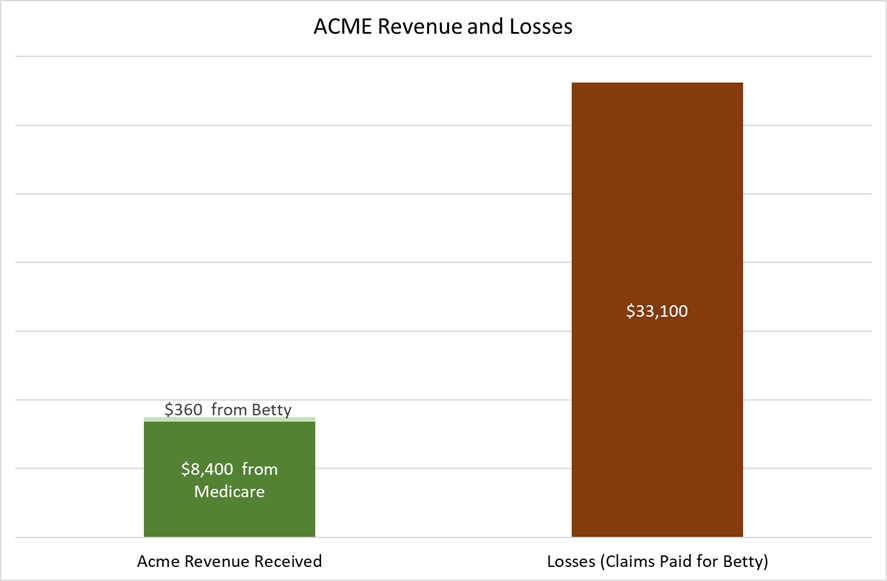

Annual Revenue that Acme Received

- Funding from Medicare = $8,400 ($700/month x 12 months.)

- Of Jane’s $65 monthly premium, $30 is for her health plan. $30/month x 12 months = $360

- Total revenue = $8,400 + $360 = $8,760

Claims paid out for Betty Smith

- Knee surgery: $29,100

- Miscellaneous other medical services: $4,000

- Total claims (losses) for covering Betty: $29,100 + $4,000 = $33,100. (Note: To keep this example simpler, we’re ignoring any prescription costs.)

A Losing Proposition

In this example, we can see that Acme losses were almost four times more on Betty’s behalf compared to the revenue they received from Medicare and Betty. Just to break even, Acme Insurance needs three other members’ (Alice #1, Alice #2 and Alice #3) revenue and little or no claims from those members.

As long as Acme only has a few Bettys and lots of Alices, they will be okay. They can maintain their $65 per month premium for 2018, keep their copays about the same, and maintain their extras such as a vision, dental, or health club benefit.

How Acme Insurance Gets in Trouble

In this example, we have the fictitious state of West Mountain. West Mountain has forty counties, and Acme has their MA plans in twenty of them. Acme’s bean counters have observed that they are consistently losing money in Wolf, Grizzly, Coyote, Rattlesnake, and Scorpion counties. These are low population, rural counties. To aggravate this problem, Medicare’s capitation rate in these counties is lower compared to the more urban ones. Worse yet, Acme is having difficulty finding enough specialists to serve on an “in network” basis in those counties.

To stem these losses and maintain the integrity of their Medicare Deluxe plan, Acme has decided to cut loose those five losing counties. They file their plan with Medicare, and they send non-renewal letters to their members in those five counties in early October. Simply put, they had too many Bettys and not enough Alices.

This is exactly what the now defunct New West Medicare did in Montana a few years ago. They had substantial losses in ten counties, so they non-renewed their members in those counties. Medicare advantage plan sponsors cannot drop an individual high claims member, but they can drop a high claims county.

In one rural county that New West dropped, I had one client that had a hip replacement surgery and another that was in the hospital in Billings for two and a half months. There couldn’t have been enough Alices to make up for those two Bettys. Also, there could have been more Bettys that I didn’t know about.

It Gets Worse

Exiting some counties can be a stop gap measure that buys time for a year or two. What happens if the losses begin to mount statewide? That’s what happened to New West in 2016. The decision makers looked at the numbers, and they weren’t good. In October of 2016, all New West MA members received their non-renewal notices.* While there were other factors in New West’s demise, the bottom line is that they lost enough money that they pulled their plans and exited the market. *Important. Be sure to keep your non-renewal notice. You may need it!

The Insurance Company has Another Option

Let’s say that Acme has lost money in most of West Mountain, but they want to stay in the game. Here’s their strategy.

- Drop their high loss counties.

- Drop their plans in the counties they wish to remain in, but come out with new plans. These new plans will have a combination of higher premiums and/or higher

- They also could trim some of their extras such as their vision or dental benefit. Your higher premiums and higher copays will generate more revenue for Acme. If it all works, they will continue to offer their plans.

Things to Remember About Medicare Advantage plans.

- Medicare advantage plans are privatized.

- The providers bill the plan sponsor (generally insurance companies) and not Medicare.

- The insurance company can’t operate at a loss, or it will go out of business.

- The company can decide which counties it desires to sponsor MA plans in any given state.

- Low population counties may not have any MA plans.

- MA plans are subject to premium and copay increases. (In a few instances these have slightly decreased.)

Conclusion

Receiving non-renewal notices for most people is an unsettling hassle. It involves change, and many people, including me, don’t like it. Now your Medicare plan needs to be redone.

I believe that having a basic understanding of how Medicare advantage funding works, can be a useful tool in your decision-making process.

Please click here to consult our companion article, I Received a Disenrollment Letter: What Now?

End

I Received a Disenrollment Letter: What Now?

By Lance D. Reedy and Isaac Reedy

By Lance D. Reedy and Isaac Reedy

A little history first, Medicare advantage (MA) plans were ramped up in 2006 as authorized by the 2003 Medicare Modernization Act passed during the Bush administration. Several insurance companies jumped into the fray offering their own version of MA plans.

In 2010 we began to see a “shaking out” with companies withdrawing their plans from certain markets. There was also some Congressional legislation that helped prompt this. The question is, what are my choices if I receive a non-renewal/disenrollment notice this fall from my MA company?

Obviously, the subject at hand does not affect Medicare supplement (Medsupp) policyholders. It also does not affect all MA plan members, it only affects some, and it certainly will affect many people in Montana. The states of Idaho, Oregon, and Washington have already gone through much of their “shaking out” and adjustments, so things have generally settled down in those states for the time being. Wyoming has already gone through this process with most counties no longer having any MA plans available.

For Those Receiving a Non-Renewal notice

The first part of your non-renewal notice states that your MA company is non-renewing your plan for 2018. It will have the usual verbiage about “changes in the marketplace, etc., etc.” The bottom line is that the insurance company is losing money in a given market and has to make some changes. Again, the causes for this are explored in our companion article, Medicare Advantage Funding and the Causes of Non-Renewal Notices. Important! Be sure to save your notice. You may need it!

Your non-renewal notice further on down will get into the nitty-gritty and lay out your options. Let’s say you have Company Green, and they have sent you your non-renewal notice.

- If Company Green is offering a new MA plan that is substantially different from your current plan with them, you can enroll in that new plan. This will require a new The premium and/or copays likely will be higher compared to your current plan.

- Your non-renewal notice also will list other MA plans that may be available in your county of residence. What adds to the confusion of these multi-page notices is that at least based on previous years, they also list some of the stand-along prescription drug plans (PDPs) that are available in your state. Put another way, those notices can throw too much information at you.If Company Red offers their MA plan in your county, that is another choice. To add to the mix, a new company may have decided to enter the marketplace. For example, Company Purple is coming to Yellowstone County (Billings, Montana) in 2018.

- Your non-renewal notice will also explain your guarantee issue rights for Medsupp plans A, B, C, F, K, and L. Be sure to save your non-renewal notice as we must attach a copy (the first page) with your Medsupp application as proof that you qualify for a guarantee issue Medsupp if you opt for this choice.

What is meant by Guarantee Issue?

Guarantee issue (GI) means just that; your acceptance is guaranteed and you cannot be declined. Even if you have a health condition that the Medsupp company would normally decline, your issue is guaranteed. Medicare has established these rules to ensure that no one gets dumped without the opportunity to get a Medsupp plan.

Example #1: John Doe had a stroke six months ago. Most Medsupp companies ask if you have had a stroke or TIA’s (mini-strokes) in the last two years and will decline your application if you have had one. With the GI rules, the health questions are waived, and John Doe can sign up for one of the six lettered plans as described above. As long as we attach a copy of the first page of his non-renewal notice to his application, the Medsupp company has to issue his policy.

Example #2: Jane Doe is on kidney dialysis. She has run up considerable copays on her MA plan and would have thousands more out-of-pocket with another MA plan. She uses the guarantee issue rules and signs up for Medsupp Plan F. Depending on her age, her premium might run anywhere from $150 to $235 per month. Again, the company cannot decline her application as long as we attach a copy of her non-renewal notice to her application.

Why would I want to pay for a higher Medsupp premium if I can get a lower priced MA plan?

As mentioned in Example #2, there are occasions when a more expensive Medsupp plan can cost you less than an MA plan. All MA plans have what’s called the Maximum-Out-Of-Pocket limit or MOOP. The legal maximum set by Medicare is $6,700. An MA company, at its discretion, may offer a lower MOOP.

Let’s say that Jane Doe has Company Black’s MA plan. Their MOOP is $5,500 and their premium is $70 per month. With her dialysis treatments, she pays 20% of the dialysis costs until she hits her MOOP. Then the insurance company pays 100% after that for the remainder of the year. Let’s say she hit her MOOP in September.

Here are Jane’s projected annual costs.

Her MOOP–$5,500

Her $70/month premium times 12 months = $840

$5,500 + $840 = $6,340

Compare the above with a Medsupp Plan F for $235 per month.

$235 x 12 months = $2,820 (Remember, she doesn’t have all the copays with her Plan F as she does with her MA plan.)

She needs to pick up a stand-alone Prescription Drug Plan (PDP), so let’s say she gets a $32 per month plan.

$32 x 12 months = $384.

$2,820 + $384 = $3,204. This is much less than the $6,240 figure for her MA plan.

If you have medical issues that can cause a lot of copays with your MA plan, then going with a Medsupp, as in Jane’s case, could cost you much less in the long run, despite the higher Medsupp premium.

Reviewing your three choices if you receive a non-renewal notice from your MA plan

- Sign up with a new MA plan from your same company, if available.

- Sign up for a plan with another MA company.

- Take advantage of your guarantee issue (GI) right and sign up for a Medsupp Plan A, B, C, F, K, or L. Note: Most people will choose Plan F because it is the most complete plan of the six choices. If you are on a budget or don’t have many medical issues, Plans K and L are worth a good look. Plan K has the lowest premium and also the most out-of-pocket costs. Plan L may be a very worthwhile solution for some people. Also note that Plans G and N are NOT eligible for GI. Exception: There is one company that offers their Plans G and N for guarantee issue.

Here are some criteria that may assist people in deciding which way they want to go.

Choose another Medicare advantage plan

- You are in good to excellent health and do little or no doctoring. Therefore, your copays will likely be minimal.

- The lower premium for an MA plan fits your budget.

- Your MA plan has a unique feature or benefit such as a health club membership, a vision or dental benefit, or an unusually low copay for a particular prescription. Remember, most of these MA plans also include a prescription plan.

Taking advantage of a guarantee issue Medicare supplement

- The Medsupp’s higher premium is worth it so you won’t have to deal with the MA copays.

- Your prescription costs will be less by shopping for a stand-alone PDP. (Remember, no Medsupp plan includes prescriptions, so you’ll likely want to sign up for a stand-alone PDP.

- This is the second or third time you have received an MA non-renewal notice and are tired of the merry-go-round. You want peace of mind.

- Your needs have changed. For example, you are traveling more and more out-of-state and would prefer not to be in a networked MA plan.

- Despite the copay responsibility that goes along with Plan K and L, you realize that these two plans may have lower out-of-pocket expense compared to an MA plan. This is especially true with the MA premiums taking some substantial increases.

Sign up for Medsupp Plans G or N, which are NOT guarantee issue.

- Your health is stable, and you want to sign up for the lower premium Plan G or N. You will have to have all “NO’s” to the health questions on the application. In general, if your health has been stable for the past two years, you likely will meet the underwriting requirements of most companies and medically qualify for either Plan G or N. Please keep in mind that the health requirements will vary from company to company.

- Let’s say that you would like to apply for a Plan G or N, but you have a health condition that will cause your application to be declined. Earlier we referenced one company that DOES offer Plan G and N on a guarantee issue basis. Their premiums are somewhat higher compared to other companies, but at least they will accept your application on a GI basis. This could be a good strategy to sign up for a GI Medicare supplement but at a lower premium compared to Plan F.

Choosing the right prescription drug plan.

Remember, no Medsupp plan covers your meds, so we’ll shop on Medicare.gov for a cost-effective PDP for your situation.

Two Time Periods

You can make your change during the October 15 through December 7 Annual Election Period (AEP). In addition, Medicare gives you a Special Election Period (SEP) that runs December 8 through February 14, 2018.

Multi-Line Agents

We offer almost all of the available Medicare advantage or Medicare supplement plans in our market, so we’ll definitely appreciate you staying with us. You won’t have to deal with seminars, calling other companies, shopping for a new agent, sifting through countless offers in the mail, or being overly stressed from confusing TV advertising.

Conclusion

For those receiving a non-renewal notice from their Medicare advantage company, we’ll be calling you. (Note: If you have recently changed your phone number, please call us.) We can’t get to everyone at once, so we thank you in advance for your patience. We will walk you through your options to arrive at the most suitable choice for your situation. We have worked hard to earn your business, and we will continue to do so.

To help give you a better understanding of why MA companies withdraw their plans from the market place, please refer to our companion article, Medicare Advantage Funding and the Causes of Non-Renewal Notices.

Final note: Please feel free to call us with any questions or concerns. Thank you. End

PDP Helper

Welcome to the PDP Helper page for Northwest Senior Insurance!

Welcome to the PDP Helper page for Northwest Senior Insurance!

Please follow the instructions below to submit a list of your prescriptions to us so we can help you select a Prescription Drug Plan for the next year.

If you would like some additional guidance on how to use PDP Helper, please check out our PDPHelper Tips article.

Gary Taubes ‘The Case Against Sugar’ Part 2

a Gary Taubes YouTube video transcribed by Liz Reedy

We ran Part 1 in our April 2017 edition of Northwest Senior News

We ran Part 1 in our April 2017 edition of Northwest Senior News

Part 2 continues beginning at 12:31 minutes

What I learned is that the German and Austrian researchers had a very different hypothesis of obesity than we do. We think that obesity is caused by taking in more calories than you expend. It’s an energy balance. I’m just curious how many of you believe that to be true. You know, you eat too much and you’re sedentary.

I once gave a lecture on why we get fat at the Tufts School of Nutrition, which is the hotbed of the anti-fat movement in America. That and the University of Washington, here are two places that really do not like my work. Before the interview I said, “How many of you believe that obesity is caused by taking in more calories than you expend.” Nobody raised a hand. And I said, “Well, I don’t have to give this lecture because I’m going to try to convince you it’s fake.”

http://medicine.tufts.edu/Student-Services-and-Campus-Life/Student-Advisory-and-Health-Office/Student-Health-Insurance/How-to-Waive-or-Enroll-in-Coverage/Friedman-School-of-Nutrition-Science-and-Policy

The counter argument is that the Germans and Austrians had come to the conclusion that obesity is a hormonal defect. Back in the 1920s, obese people would say, “Well, it’s hormones.” And it was considered an excuse even back in the 1920s before any hormone but insulin had been discovered. People had no idea how hormones work in the human body.

The medical community would say this was an excuse for fat people to not eat in moderation like lean people would. This idea, built up through the 1960s, was hammered on over and over again. It can’t be a hormonal defect; “fat people just don’t have willpower like I do”, was the implication.

The Germans and Austrians said that it was clearly a hormonal defect; it’s got to be a hormonal defect. I mean, look at it. Men and women fatten differently. It means that sex hormones are involved, right? Men and women go through puberty, the boys lose fat, the girls gain fat; it’s the sex hormones, you know? You get these localized accumulations of obesity. One of the most famous is called the steatopygia. [also spelled steatopigia: the state of having substantial levels of tissue on the buttocks and thighs]

Anyway, World War II comes along, the German and Austrian schools vanish. Some of these researchers fled to the United States but they didn’t get jobs because nobody wanted to hire these German Jewish researchers; certainly not Ivy League institutions, which actually had protocols in place so as not to be overrun by Jewish admissions and Jewish students. In fact, a lot of them ended up moving west, and it’s one of the reasons that places like Washington and Berkeley, where I live, are such great universities because they embraced these people.

This idea that obesity was a hormone regulatory defect evaporated with the Second World War. After the war, very well-meaning US nutritionists and young doctors sort of recreated the science of obesity from scratch with no idea how to do science and no understanding of endocrinology or genetics or metabolism and even profoundly, nutrition.

They ended up with this idea that it’s just about eating too much. Gluttony and sloth. It was like a Biblical theory of obesity. In the 1960s when researchers started to understand what it is that actually regulates the accumulation of fat in your fat cells, by that time we had already decided that obesity was an eating disorder caused by taking in too many calories. Nobody cared what the endocrinologists were learning about obesity. Ed: We’re at 16:36 minutes.

I was doing a BBC TV show in which they were interviewing me in Oakland via Skype. The host of the BBC show was a geneticist who studies obesity at Cambridge University. He studies the genetics of obesity. He got a little angry at me because I kept asking him questions when he wanted to ask me questions.

One of the questions I asked him was “Do you know what regulates fat accumulation in fat cells?” And he said, “Well, we don’t know that.” And I said, “No, you don’t know that because you studied genetics.” But if you pick up an endocrinology textbook or a biochemistry textbook, it’ll tell you about the hormone insulin, [and it will] tell you what enzymes are in insulin that regulate and pull fat in or out of fat cells.

Anyway, this whole story ties back to sugar. If obesity is a hormonal regulatory defect and if it’s more or less controlled, as the endocrinology and biochemistry textbooks will tell you, by the hormone insulin, then whatever works to elevate insulin in your bloodstream is going to make you accumulate excess fat; that thing happens to be sugar.

My Comments: Sugar and the other refined carbohydrates in our processed-food diet is one of our major health problems. Anyone who writes and knows anything about nutrition warns us about this problem.

William Dufty in Sugar Blues described his battle with sugar addiction and how destructive sugar was for his health. Dr. Stephen Sinatra in Chapter 4, Sugar: The Real Demon in the Diet of The Great Cholesterol Myth writes as to how sugar contributes directly to heart disease.

The problem for us is the pervasiveness of sugar in our diet. Even in things touted as being good for us such as “organic” can be remarkably high in sugar. A client recently told me about her favorite bread, Dave’s Killer Good Seed Organic Bread with the yellow wrapper. The nutrition information indicates 5 grams of sugar per serving with one serving being 140 calories. 5 grams x 4 calories per gram = 20 calories per slice. 20/140 reduces to 1/7, meaning that around 14% of the calories are sugar. Obviously, a loaf of bread such as this is light years better than white foam bread, however it is still a hidden source of sugar. To Dave’s credit, some of their other lines have less sugar.

Continuing: Again, it’s targeting this condition of insulin resistance. If you’re insulin resistant, your pancreas has to pump out more insulin to make take up the high blood sugar in your body and deal with it. Basically, you have a very strong chain of effects that would implicate whatever is the cause of insulin resistance, obesity, and diabetes.

Again, I think it’s vitally important in doing this story to understand the history. So much of this book [ he is referring to his book, The Case Against Sugar.] is about the history. I’m also saying in 2016 we’ve missed the story. So, I’m making this argument that the nutrition community got it wrong, the obesity community got it wrong despite the anti-sugar movement.

The question is: why is the anti-sugar movement about sugar being empty calories if we consume an excess, whatever that means. Nobody ever says lung cancer is caused by smoking in excess, right? You say it’s caused by smoking. But we’ll say obesity is caused by consuming foods in excess. Is it just caused by consuming foods, just as lung cancer is caused by smoking?

What I had to do with this book is explain why such a profoundly important hypothesis had been ignored. Something I argued time and again is that the evidence is actually ambiguous. I’m speculating by saying sugar causes all these diseases. Why is it in 2017 I have to speculate we haven’t done the research necessary to narrow it down.

The other part of the story is how the sugar industry worked in the 50s, 60s, and 70s to take what the nutritionists were giving them and make sure no one ever concluded that sugar was uniquely toxic. This is not a short-term toxin like we’re used to, like a chemical which might kill you if you inhale it for three weeks, but a long-term toxin that works over years and decades to create these chronic conditions, diseases, and disorders that are so burdensome, and will eventually shorten your life like no other.

My Comment: This is why so many people find it difficult to realize that their stent placement, obesity, stroke, cancer, or heart illness is the result from past decades of nutritional abuse. I have been in homes and seen processed, sugary junk foods sitting on people’s kitchen counters. Invariably they are taking several meds for blood pressure, heart regulation, and/or type 2 diabetes. They also tend to be overweight.

Continuing: Much of what I do in this book is also to talk about the history of the sugar industry and their public relations campaigns. They ran concerted campaigns in the 60s and 70s, first to fight back the challenge that artificial sweeteners presented in the 60s. It’s funny because people like to say it’s a surreptitious campaign by the sugar industry, but I first realized this happened because I was reading a New York Times article.

In 1967, a vice-president of the sugar association took credit for spending almost a million dollars to fund studies to demonstrate that cyclamates were carcinogenic. And to a New York Times reporter he says, “Look, if some competitor can undersell you ten cents to a dollar, wouldn’t you throw a brick bat at him if you could?”

It wasn’t a surreptitious campaign, it was just capitalism at its best. Artificial sweeteners came into the market in the 1950s. By the 1960s they were taking over the soda industry and the sugar industry felt they had to fight it back. So they did. They funded studies and they got cyclamates banned, and they almost got saccharine banned based on science that was almost unbelievably bad.

In the 1970s, when a very influential British nutritionist named John Yudkin was claiming that sugar was deadly and that it was probably the cause of diabetes and heart disease, the sugar industry funded a campaign of researchers who believed saturated fat was the problem.

Comment: Weren’t they clever by scapegoating saturated fats?

Continuing: The nutritionists and cardiologists in the United States had concluded that saturated fat was what caused heart disease, and if it caused heart disease, then it caused diabetes. All they had to do was pay the nutritionists to stand up and write what they really believed. What they believed was that sugar was benign.

This report produced by the sugar industry had been designed as a part of a public relations campaign by a hot-shot public relations firm in Chicago. The report was called Sugar in the Diet of Man. It was about ten or eleven articles supplemented in a journal. They gave it to the FDA, and the FDA had to decide whether sugar was safe or not. The FDA read the report and said, “Clearly, these very influential nutritionists believe sugar is benign, so we will too.”

One thing led to another, and the end result was that they managed to, in effect, shut down sugar research in the country for about thirty years. In fact, by the mid-1980s, for someone to say sugar might be harmful and to study it, was to be accused of being a quack. It wasn’t just that the NIH wouldn’t fund such studies, but it would actually ruin your reputation as a scientist if you claimed to do it.

What happened was some research was done anyway. One of the paradigm shifts I talk about in all my books is in the 1960s we focused on the idea that we get heart disease because fat raises the cholesterol in our blood and our arteries clog up. We often use this clogged pipe analogy. Some people talk about artery-clogging fats. Stop at 23:32 minutes Continued next month

My concluding comment for this month: For those who have followed our review and digests of Dr. Stephen Sinatra’a The Great Cholesterol Myth, we have learned that the demonization of saturated fats and cholesterol has been one of the greatest nutrition and health frauds of the past 60 years. End

Busting the Top Five Medicare Myths

by Lance D. Reedy

I have been a member of the Society of Certified Senior Advisors for several years and receive their publications both in print and online. Their recent article, Busting the Top Five Medicare Myths, caught my attention. I have paraphrased these myths below and added pertinent comments as necessary to fit our five states of ID, MT, OR, WA, and WY. Please click here to review the article in its entirety.

I have been a member of the Society of Certified Senior Advisors for several years and receive their publications both in print and online. Their recent article, Busting the Top Five Medicare Myths, caught my attention. I have paraphrased these myths below and added pertinent comments as necessary to fit our five states of ID, MT, OR, WA, and WY. Please click here to review the article in its entirety.

Myth 1: I can enroll any time I want to.

One of the biggest misunderstandings about Medicare supplement (Medsupps) concerns the Annual Election Period (AEP-also known as Medicare open enrollment) that runs from October 15th through December 7th. For additional information, please refer to our companion article in this issue titled Have Your Medicare Supplements Rates Gone Up?

I have heard this statement over and over: “Oh, I thought you can change your Medsupp during open enrollment (meaning the AEP).” The AEP is all about changing your Part D prescription plan (PDP) or your Medicare advantage (MA) plan. It has very little to do with Medsupps.

In general, once you are past 65 and a half, changing your Medsupp from one plan to another requires medical qualification. There are some exceptions. Washington allows you to change your plan virtually any time without medical qualification. Oregon allows you to do the same during the month of your birthday. The other eleven months you can change your Medsupp subject to qualifying medically

In Idaho, Montana, and Wyoming, you can change your Medsupp any month of the year subject to medical qualification.

There is another twist to this. If you have been on a plan that disenrolls you, such as an MA plan, then you can use the guarantee issue rules to sign up for Medsupp plans A,B,C,F,K, and L with NO medical qualification. Guarantee issue, means just that, your acceptance is guaranteed, even if you have a substantial health issue such as a recent heart attack.

Myth 2: Medicare pays for long-term care.

Medicare covers 20 days at 100% for skilled nursing facility care after a medical event such as a stroke or hip replacement. Medicare will cover another 80 days, subject to fairly strict qualifications. There is also a $164.50 per day coinsurance (in 2017) which most Medsupp and MA plans cover.

Myth 3: Medicare covers all my health expenses.

Congress passed the Medicare legislation into law in 1965 to keep seniors from being financially wiped out due to high medical costs. That was the purpose for the original legislation. Over time, more things have been added such as preventative procedures and home health care.

Medicare was never intended to cover dental, routine vision care, cosmetic surgery, and custodial care in a nursing home.

Myth 4: Medicare is free.

Most native-born people receive Medicare Part A hospitalization at no cost. Part B, medical, has a premium in 2017 for new enrollees of $134 per month. People in higher income brackets have higher Part B premiums.

Myth 5: I don’t need to enroll in Medicare.

There is no one pointing a gun at your head saying that you MUST enroll in Medicare Part B or else. However, it’s a smart idea to do so. The CSA website article gives some tips for those that are on an employer plan.

However, the CSA article has a glaring error that none of their proofreaders caught regarding the late enrollment penalty (LEP) for not signing up for Medicare Part B. Here is the erroneous text:

That penalty means premiums can go up almost 10 percent for every month you are eligible for Medicare but not enrolled.

The 10 percent late enrollment penalty should read “can go up almost 10 percent for every year (not month) you are eligible….”

Conclusion: The error in Myth #5 is a good example of how a single word mistake can cause misinformation. Sadly, this is all too prevalent in much of what you hear on the street, from the senior center, the news media, and even from supposedly knowledgeable people such as the Council on Aging.

Where do you go to obtain accurate information? Medicare.gov is an excellent source. Additionally, AARP also has lots of good info about Medicare.

Finally, your pro agents, meaning us, endeavor to be a trustworthy source of information, and admittedly, we’re still in the learning process. If you have a question where we don’t have the answer, we’ll research it and get back to you with the most accurate and reliable information we can find. End

Causes of Medicare Supplement Premium Increases

by Lance and Isaac Reedy

In our Have Your Medicare Supplements Rates Gone Up? article we discuss what you can do if your rates have gone up. In this companion article, we talk about the two main causes of these increases. Think of them like two rivers that come together to form a larger one.

In our Have Your Medicare Supplements Rates Gone Up? article we discuss what you can do if your rates have gone up. In this companion article, we talk about the two main causes of these increases. Think of them like two rivers that come together to form a larger one.

Cause #1: This one is the attained-age pricing that most states allow for their Medsupp plans. Here’s how it works. Company X has a rate, let’s say of $100 per month for a Plan G at age 65. Their rate chart says “Attained -age.” Company X takes its first attained-age increase at age 66. From there it increases at the rate of 3.5% per year. Their rate chart would look like this:

Attained-age Plan G

- Age 65: $100.00

- Age 66: $103.50

- Age 67: $107.12

- Age 68: $110.87

- Age 69: $114.75

- Age 70: $119.06

In this case, your premium increases 3.5% beginning at age 66 and every year thereafter. Some companies end their attained-age increases at age 80, and others go to age 99.

There are some variances for attained-age pricing. Company Y takes its first attained-age increase at age 68, again with a rate increase of 3.5% per year. Their rate chart would look like this:

- Age 65: $100.00

- Age 66: $100.00

- Age 67: $100.00

- Age 68: $103.50

- Age 69: $107.12

- Age 70: $110.87

Everything else being equal, I would choose Company Y over Company X for someone signing up at 65.

Just because a state’s insurance department allows attained-age pricing, doesn’t necessarily mean that all companies use it. A company at its own prerogative may choose issue-age pricing instead. Issue-age pricing means that if you sign up for a Medsupp at 65, let’s say with Company Z, you are always in the 65 year-old rate category. Since you are issued at age 65, your premium does NOT increase just because you advance in age.

Company Z’s rate chart may look like this.

Issue-age Plan G

- Age 65: $120.00

- Age 66: $120.00

- Age 67: $120.00

- Age 68: $124.80

- Age 69: $129.79

- Age 70: $134.98

If you come in at age 69, for example, your premium will be $129.79 per month, and then you will always be in the 69 year-old group.

Here’s the breakdown of how attained age pricing (if allowed) works in the five states we work in.

Idaho: An Issue-age state. Does not allow attained-age priced policies. The premiums typically start around $20 per month higher compared to attained-age pricing.

Montana: An attained-age state. Virtually all companies use attained-age pricing. Many of you have a company that is the exception and uses issue-age pricing.

Oregon: An attained-age state. All companies that I know of use attained-age pricing.

Washington: A community rated or flat-rate state. Each companies’ Medsupp plan letter has its own flat rate. It doesn’t make any difference for smoker or non-smoker, your age, or male vs. female. The rate is flat, period. Plan G’s might run around $180 per month.

Wyoming: An attained-age state. All companies that I know of use attained-age pricing.

Here’s the bottom line. Many people in Montana (but not all), Oregon, and Wyoming will have attained-age rate increases. Idaho, Washington, and those in Montana with an issue-age policy do not. However, the trade-off is that premiums usually start higher.

Note: One company in ID, MT, OR, and WY has its own unique pricing structure, which functions similar to attained-age pricing.

Cause #2: All Medsupps eventually increase in premium due to the claims experience that any given company incurs. Let’s say Company W offers Medsupp plans F, G, and N.

As far as claims and premiums go, the people on Plan F are in one bucket, the people on Plan G are in their own bucket, and the Plan N folks have their own bucket. Premiums are money going into the bucket, and claims experiences (losses) and administrative expenses are money going out of the bucket.

Let’s say that the policyholders in Company W’s Plan F bucket as a group, begin to have more medical procedures. For example, John Doe has an unexpected open-heart surgery and Jane Doe starts a chemo therapy regimen after a mastectomy.

Those two cases will incur substantial claims for the company and cause more money to flow out of the bucket. Let’s say that there are also other Company W policyholders that increase their medical utilization of their Medsupp plan. The losses mount.

Finally, it gets to the point where Company W goes to the State Insurance Department, documents their increased losses, and files for a rate increase. If it’s 6%, for example, then everyone in Company W’s Plan F bucket goes up 6%. It makes no differences whether a policyholder has huge bills and another has had no claims at all. If the premium increase is 6%, then everyone goes up 6%.

As the people in any company’s block of business begin to age (I hate to put it that way, but it’s the truth), the claims experience inevitably increases. The older standardized plans purchased prior to June 1, 2010 are all closed blocks of business and have increasingly greater rates of claims experience. That has put more pressure on rates.

More claims experience = more losses = premium increases.

There is another tributary to the Claims Experience River, the North Fork. When Medsupps were initially offered, beginning in 1966, most plans covered the Hospital Part A deductible, just as most plans do today. In 1966 the Medicare Part A deductible was only $40. It wasn’t too long ago that it crossed over $1,000. In 2016 it was $1,284, and in 2017 it’s $1,316. It likely will be pushing $1,350 in 2018.

Each year, as a policyholder is hospitalized, Company W has to pay out more money in claims. Even if the rate of hospitalizations is the same on a per 1,000-policyholder basis, the insurance company continually has to pay out more money.

Other Medicare deductibles and co-insurances also increase. As the Medsupp company continues to pay its own share of the costs, it has to pay out more and more every year coinciding with the increased obligations from Medicare. In fact, the companies usually send their policyholders a notice in the fall stating that they will automatically cover Medicare’s increases.

To sum up: As the company’s block of business ages, you have increasing medical utilization as well as gradually increasing deductibles and co-insurances from Medicare. Both of these flow together causing more losses for the insurance company, and unfortunately, this ultimately leads to claims experience rate increases.

Conclusion: Both attained-age increases (OR, MT, and WY) along with increased claims experience (losses) will cause your Medsupp premiums to go up. The increases in ID and WA are due to claims experience only. While that’s nice for those two states, keep in mind that their rates start higher from the get-go.

What can I do to find lower rates?

Please refer to our companion article, Have Your Medicare Supplements Rates Gone Up? In addition to shopping for lower rates in general, sometimes switching from a Plan F to Plan G or Plan G to Plan N can be a smart more. If you have an older plan that has had substantial rate hikes and your health is stable, the chances are good that we can qualify you for lower rates.

Please contact us, and we’ll start shopping for you. End

Have Your Medicare Supplement’s Rates Gone Up?

by Lance and Isaac Reedy

Note: We have updated this article from a year ago. Unfortunately, Medicare supplement rates continue to increase. The good news is that if your health is stable, you may be able to qualify for a lower cost plan.

One of the most annoying things that happens in life, especially if you are on a fixed income, is some expense that has a rate increase. Unfortunately, health costs continue to rise including Medicare supplement (Medsupp) premiums. For a more detailed explanation about the causes of these increases, please read our companion article, Causes of Medicare Supplement Premium Increases.

During the past year most companies have had rate increases of some extent or another and some more so than others. What can be done about these rate increases? The solution, of course, is to have us shop on your behalf for lower rates. Remember, you can change your Medsupp plan any month of the year, providing that you medically quality. More about medical qualification shortly.

If you have Plan F with Company X, a good solution is to switch to Plan G or even Plan N. Again, this is assuming that your health is stable and that you can qualify for another plan.

For those people with declinable health issues the solution to this situation may be to switch to a Medicare advantage plan during the fall Annual Election Period (AEP also known as Medicare open enrollment) that runs from October 15th through December 7th. We will have more information forthcoming about the AEP in the next issue of Northwest Senior News and also via a paper newsletter for those do not have email access.

Why is it much easier to switch to a Medicare advantage (MA) plan?

The only health question on an MA application is kidney failure. You could have had a recent stroke, been treated for cancer in the past two years, or have multiple sclerosis, and you can still qualify for an MA plan. Those conditions would generally cause a decline on a Medsupp company’s application.

However, switching to an MA plan may not be feasible for many people, especially if you live in a county that has no available MA plan. The following are some examples.

- Idaho: Clearwater, Idaho, Lewis, Benewah, and Shoshone counties in northern Idaho are prime examples of counties with no MA plans.

- Montana: Counties such as Park, Glacier, Toole, Hill, Blaine and others have no MA plans.

- Wyoming: Most counties have no MA plans.

- Washington: Some of the smaller or more rural counties have no MA plans available.

- Oregon: Please contact us.

While there are some distinct advantages of MA plans, there are also some negatives. Here are some of them.

- You have copays for most of your medical services.

- Your medical providers generally need to be in the plan’s network.

- The specialty clinics such as Mayo, Virginia Mason, and Fred Hutchinson generally do not take MA plans.

- You will have higher out-of-network copays (often as high as 50%) if you are out of the plan’s service area or network.

- More recently there is the hassle of getting prior authorization for major Medical services.

How do I qualify for a new Medicare Supplement plan?

To qualify for a new Medsupp plan, you will need “No” answers to the following health questions. The language for each company’s application will be a little different, but in general, here are the most common ones.

1) In the last two years have you had or been treated for circulatory or heart disease including a heart attack, heart bypass surgery, stent placement or pacemaker implantation?

2) Have you been treated for internal cancer or melanoma in the last two years? (Does not include most skin cancers.)

3) Have you had a stroke or mini-stroke in the past two years?

4) Have you been diagnosed or treated for COPD, emphysema, or chronic bronchitis in the past two years?

5) Have you been hospitalized more than two times in the last two years?

6) Have you been diagnosed with any type of dementia, Alzheimer’s, or Parkinson’s disease? Note: One of our companies will take people with these conditions providing that there are no other major issues.

7) Do you have any planned surgeries such as joint replacement surgery of cataracts recommended to be completed in the next twelve months?

8) Do you have any auto-immune disease such as AIDs, HIV, multiple sclerosis, rheumatoid arthritis etc? (Other diseases may be included depending on the company.)

These are the major categories. A company may request additional information.

Routine prescriptions such as blood pressure, cholesterol, and type 2 diabetes meds are usually okay. Most companies have a drug decline list. Examples of what could be on such a list are opioids and many cancer related drugs. Most companies require that you list all prescription meds on your application. Certain combinations of drugs such as ones used to treat diabetes (particularly insulin) and hypertension may be a problem.

Why do we pre-qualify before applying?

If you have a medical condition that is iffy, we can shop for the company that is most likely to accept your application. For example, if we know that Company X will decline your application due to a medical condition or drug on their decline list, then applying to that company would be a waste of your time. We’ll look for a different company. Through the years, we have learned that a health issue that may not fly with one company can go through with another. For example, there is one company that does not decline Alzheimer’s disease, Parkinson’s disease, rheumatoid arthritis, or multiple sclerosis.

Contacting You

We are rapidly getting into our crazy time of the year as we have to go through our annual recertification process for MA and Part D prescription plans. However, we will endeavor to contact as many of you as possible by phone. Please feel free to move to the front of the line by contacting us at (208) 746-6283 or (888) 746-6285, or by email at lance@nwsimail.com.. If you have a health situation that you believe may be an issue, contact us anyway, and we’ll see what we can do. End

Benefits of a Medicare Supplement Plan

Introduction

The following table lists all of the possible benefits of a Medicare supplement plan. Plan F is the only plan that contains all of these benefits.

Basic Benefits

- Part A coinsurance. The Medicare supplement will pay the $315 per day coinsurance for days 61-90 of a hospital stay. The Medicare supplement will pay the $630 per day coinsurance for the 60 lifetime reserve days. The Medicare supplement will pay for 365 additional days of hospitalization after Medicare hospitalization benefits are exhausted.

- Medical expenses Part B: The Part B coinsurance is generally 20% of Medicare approved expenses. This includes the coinsurance for outpatient services and surgery. Plans K, L, and N require the Medicare beneficiary to pay a portion for the Part B coinsurance. ***Details below.

- Blood: The first three pints of blood.

- Hospice: The Medicare supplement pays the hospice coinsurance.

Skilled Nursing Facility coinsurance

- Medicare pays 100% for the first 20 days for an approved stay for skilled nursing facility care.

- For days 21-100 Medicare will pay for an approved stay. There is a $157.50 per day coinsurance that the Medicare supplement pays. ***See below for Plans K and L.

Part “A” Deductible

- For 2015 the Medicare Part “A” deductible is $1,260 per hospital benefit period. The benefit period is for 60 days and begins after one’s discharge. The Medicare supplement could pay this benefit more than one time per year. .***See below for Plans K and L

Part “B” Deductible

- 1. The Medicare Part “B” deductible is an annual $147 in 2015.

Part “B” Excess (100%)

- 1. In general, if a Medicare Part “B” provider charges an excess above the Medicare approved amount, this benefit will pay that amount. Physicians may charge a maximum of 115% of the Medicare approved amount. These are known as non-participating physicians or physicians that do not accept Medicare assignment.

Foreign Travel Emergency

- In general, Medicare does not pay in foreign countries. One will pay the first $250 for Medical services. After that, the Medicare supplement will pay 80%, and the insured will have a 20% coinsurance. Usually one must pay his/her bill upfront and then bring the bills back to submit a claim.

Out-of-pocket limit

- 1. For Plan K there is a maximum annual out-of-pocket limit of $4,940. The Medicare supplement will pay 100% after that limit is reached.

- 2. For Plan L there is a maximum annual out-of-pocket limit of $2,470. The Medicare supplement will pay 100% after that limit is reached.

High-deductible Plan F

- High-deductible Plan F pays the same benefits as Plan F after one has paid a calendar year deductible of $2,180. This deductible is for what the Medicare supplement would have paid. Medicare still pays its part when one has high-deductible Plan F. After one has met the deductible, then the plan pays just like a regular Plan F.

***Details for Plans K, L, and N

- Plan K: Hospitalization and preventative care paid at 100%. Other basic benefits are paid at 50%. Pays 50% of the skilled nursing coinsurance. Pays 50% of the Part A deductible.

- Plan L: Hospitalization and preventative care paid at 100%. Other basic benefits are paid at 75%. Pays 75% of the skilled nursing coinsurance. Pays 75% of the Part A deductible.

- Plan N: The insured pays a maximum $20 copay for a doctor’s office visit and a maximum $50 copay for an emergency room visit.

Quiz: Your shopping type

Emotions and Sentiments or Knowledge and Understanding.

Pick whether you believe the statements listed below are primarily based on Emotions and Sentiments or Knowledge and Understanding.

The agent said to get Plan F so you don’t have to pay anything.

You have to pay a higher premium for Plan F compared to Plan G. Depending on your state, the Plan G may be a better value so you will pay less compared to Plan F.

The Council of Aging people told me that this national organization’s Medicare supplement was better, so I should go with that one.

Bless their hearts, but unfortunately the CoA volunteers have made plenty of gaffs. This is another one. The benefits for the Medicare supplement plans are standardized. If the CoA volunteers are recommending a large, name brand Medicare supplement that is more expensive than a smaller company’s plan, aren’t they actually doing a disservice for their audience?

My neighbor said that this (Brand X) is a good one.

It’s good based on what? This is invariably based on opinions that are based on feelings.

Do they pay?

They all pay! Any thinking or suggestions that any given company doesn’t pay is flat out wrong.

I’ve never heard of that company (Brand Y) before (with a worried tone implying that it may not pay).

It doesn’t make any difference if you have heard of the company or not. They all pay!

But, can they drop me?

As long as you pay your premium the company cannot drop you, no matter how many claims you have had. Every Medicare supplement policy says this in its policy language.

That company is only in a dozen states (fearing that the company is too small and may not pay its claims).

They all pay their claims. They also pay claims in all 50 states, even if they do not write business in a given state. Additionally, the smaller companies can have stronger financials compared to the larger ones.

They treated me really good.

The company did not single you out to “treat” you well after they paid a claim of yours. They simply performed their end of the bargain… You pay your premium, and they pay your claims if and when they occur. It’s simply a business obligation on their part.

My husband has this one, so I might as well get the same one.

What if your husband's plan is overpriced now? Why overpay if you don't have to?

I’ll call an 800 number because I want to cut out the middle man.

I heard this one from a gentleman that was misled by the Council on Aging. There is no “middle man”. The rates are all filed with the state insurance department, and it makes no difference whatsoever, as far as the premium goes, if you purchase your plan from an agent or through a company’s 800 number. When you sign up via an 800 number, you pay a commission to an agent that you will undoubtedly never see. In addition, you usually pay more than you need to, because the 800 number order takers aren’t looking out for your best interests. They don’t explain to you other lower cost options.

I don’t want to change.

This is a fairly common sentiment. It basically boils down to this: The devil I know is better than the one I don’t know. Knowledge of the Ten Mistakes, especially number one and two, can help overcome this fear. A new, lower cost company will pay its claims just as well as your old company.

I want to get the most bang for my buck.

Usually these people want to listen to the facts and get the best buy. They understand the basis for going with a particular plan. They quickly grasp recommendations to help them get the best buys. They tend to be less swayed by hype.

I don’t care about a more competitive price; I just want to make sure they pay.

Again, this statement is based on the fear that a particular company may not pay its claims.

I wan my plan to cover everything that Medicare doesn’t.

No plan covers non-Medicare covered expenses. It’s correct to say the following: My Plan F covers both deductibles and the co-insurances not covered by Medicare. This is true with any Plan F.

I’ll go through all of this (meaning the stuff in the mail), and when I figure it out, I’ll call you.

This is more of a brush-off. This person won’t figure everything out because relying on what comes in the mail is like playing poker or pinochle with nine cards missing from the deck.

I don’t want to have to pay any deductibles or copays.

See number one. A higher premium for Plan F in many cases incurs more out-of-pocket costs compared to Plan G. People, and agents, conveniently forget that your premium is also an out-of-pocket cost. Now, if you say that you are perfectly willing to pay, let’s say $300 to buy a $182 benefit (in 2017) benefit, then you could argue for Knowledge and Understanding.

I trust the Council on Aging folks.

Why and based on what? While Council on Aging people do have a minimal training session, they are not insurance licensed. Unlike insurance agents, they aren't required to take Continuing Education courses. Lastly they don't have to annual re-certify for Medicare Advantage or Part D plans as insurance agents are required to do.

I like the one I have.

People tend to like what they own. For example, most owners like their car. This common sentiment also crosses over to intangibles such as insurance products. Now, do you like paying $0.50 to $1.00 more per gallon for gasoline than you need to? Probably not. So why do people persist in paying more for a Medicare supplement than they need to? I believe that it comes back to the fear of change or fear that another company won’t pay. For others it’s a pride thing. People don’t want to admit to themselves that they made a bad buy.

I know I don’t understand all of this, so I want you (an insurance professional) to help me.

These people know their limitations, and they know they need help. It’s also been my experience that these types of people are some of the best and easiest ones to work with. The only caution I have for these folks is they don’t allow themselves to get led astray by a bad agent.

Share your Results: