by Robert H Lustig, MD, MSL

by Robert H Lustig, MD, MSL

Synopsis of Report #1

Lustig’s central thesis is that corporations and governments are purposely conflating (mixing up two opposite concepts) pleasure and happiness. This is being done for their gain and at the expense of the person that is left confused by the conflating of these two distinctly different but related concepts.

Pleasure: Enjoyment or satisfaction derived from what is to one’s liking; gratification. While pleasure has a multitube of synonyms, it has a specific, well understood “reward pathway” in our brain.

Happiness: The quality of being happy or contentment. I’ll skip over the philosophy of Aristotle that he cites to further explain happiness. Contentment says that I’m satisfied; it’s not necessary to seek more.

Chapter 1: The Garden of Earthly Delights

Chapter 1 to a large extent reiterates the concepts that Lustig proposes in his introduction. Let’s see what we can gleam, however, from this chapter.

Lustig poses the question, why are so many people miserable? He also points out that many rich people are unhappy. Additionally, he points out that some people claim that the argument between pleasure and happiness is a “straw man.” He asserts that it does matter and that the differences between these two otherwise positive emotions forms the narrative arc of this book.

He explains that pleasure is the “reward pathway” and happiness is the “contentment” pathway. Lustig also concedes that the definition of happiness has changed over time.

He spends page 19-20 discussing how various religious traditions have dealt with the concepts of pleasure and happiness. He says that the definitions of these words are a moving target.

Because people want to learn how to be happier, numerous pop psychology books have appeared in recent decades, ostensibly leading people on the way to the happiness that they seek. However, most of these books confuse pleasure with happiness.

Until you can distinguish the difference between these two emotions, you can’t recognize either one as unique and you can’t understand, let alone fix, the problem for yourself and for your family.

One Origin of the Confusion

Lustig says that if you “google” happiness you will find definitions such as pleasure, joy, bliss, contentedness, etc. He points out to the reader that this is a classic example of conflating pleasure and happiness. I’ll skip past his references to Aristotle. He shows how academics such as those at Stanford University have conflated pleasure and happiness. He quotes from the Stanford Encyclopedia of Philosophy:

Happiness: Hedonism (maximization of pleasure) …

Lustig is not happy about Stanford’s conflating his two key concepts that drive his book. He spends the reminder of page 24 discussing some philosophical nuances of pleasure and happiness.

Lustig concludes chapter one:

And as corporations have profited big from increased consumption of virtually everything with a price tag promising happiness, we have lost big-time. America has devolved from the aspirational, achievement oriented “city on a hill” we once were, into the addicted and depressed society that we’ve now become. Because we abdicated happiness for pleasure. Because pleasure got cheap.

My comments: All through school I struggled with abstract concepts, and I’m struggling again. I’m fully sympathetic with anyone who thinks the following as he/she reads this summary: “I’m not sure that I understand all of this. Let’s see if this helps.

As a pre-adolescent emerging into adolescence, I loved drinking soda pop. It was sweet, fizzy, and tasted good. Back in those days soda pop was marketed in returnable bottles with deposits. I marveled with a friend when we bought a bottle of Royal Crown Cola. Why? The Royal Crown came in a 16-ounce bottle instead of the standard 12-ounce bottle. Coke was still being sold in 8-ounce bottles.

That extra 4 ounces of pop delivered more pleasure that lasted longer as I drank it down. As it fed my sugar addiction, it certainly didn’t add to my long-term happiness. In fact, because the massive sugar fix that I was imbibing contributed to weight gain, which contributed to me becoming more depressed.

Fast forward from the 1950s to today. Pop is still marketed and sold in 12-ounce cans. However, the 20-ounce plastic bottle has now become the new norm. That 20-ounce bottle has 67% more bad stuff compared to the old, 12-ounce can. And don’t think you’re getting off the hook if you consume “diet.” It’s all bad.

If the 20 ounce “new” serving size wasn’t big enough, the liquid candy purveyors are now marketing 24 ounce and 1-liter single serving sizes. However, the sales in recent years has been lagging for these super-sized servings, so the liquid candy folks have originated a clever new marketing gambit.

The liquid-candy-in-a-can folks are now marketing a 7.5-ounce can that sells for more than 12-ounce cans! This is something like $0.50 per can versus the $0.31 for a 12 ounce can. Or put another way, the liquid candy drinker now pays more for his/her smaller sized fix compared to a larger size.

A couple of years ago I attended an insurance meeting in Denver, and as a treat for the attendees, the sponsoring agency bussed us to a Colorado Rockies baseball game at Coors Stadium. The last major league baseball game I attended was around 50 years ago at Dodger Stadium in Los Angeles. Was I in for a rude shock.

During every inning break we were bombarded with a plethora of advertising, especially for soda pop, on the brightly lit, monster outdoor screens. I vividly remember one of the scenes of the HAPPY young adults romping around and having fun while guzzling down their liquid candy. Their heads were tipped back with their pop bottles tipped upside down at a 60-degree angle. The close-up shots showed the imbibers’ throats flexing as they swallowed their caffeinated candy. I don’t think it’s a stretch to suggest that the scenes had sexual overtones.

I can’t think of a better example of Lustig’s narrative of the conflating of pleasure and happiness. He also repeatedly hammers at the theme that the corporations’ conflating of pleasure and happiness is done at the expense of the consumer, or more accurately, the unwitting victim. That could be you!

Warren Buffet’s Berkshire Hathaway collects around $500 million dollars per year in dividends from the Coca Cola stock that he purchased around 30 years ago. On December 1, 2012 the value of one Class A share of Berkshire Hathaway’s stock (BRK-A) was around $152,000. BRK-A hit $325,000 plus on January 22, 2018. That’s a doubling of wealth in a little over five years!

Every consumer that purchases Coke products (or any other liquid candy brand for that matter) has contributed to that explosion in wealth. It’s a they win, and you lose proposition. Meanwhile we hear on the news that America’s middle class in shrinking. We hear reports of the startling high percentage of seniors that are living at or below the poverty line. An exhaustive study of the causes of this occurrence is way beyond the scope of this chapter summary.

However, here is what Lustig is trying to get across to his readers. Drinking that liquid candy offers temporary pleasure, but let’s look at what happens for all too many people. That after effects include but are not limited to the following:

- Weight gain and obesity

- Please remember that the “diet” form of liquid candy introduces toxic substances such as aspartame or sucralose (Splenda) into your body. The evidence is clear that “diet” increases your appetite and is totally counter-productive as far as losing weight goes.

- Type 2 diabetes

- Heart disease

- Stroke

- Cancer

- Increased dental costs due to the phosphoric acid in colas eating away the enamel on your teeth. I have received many calls from people needing thousands of dollars with of crowns, implants or other expensive dental work.

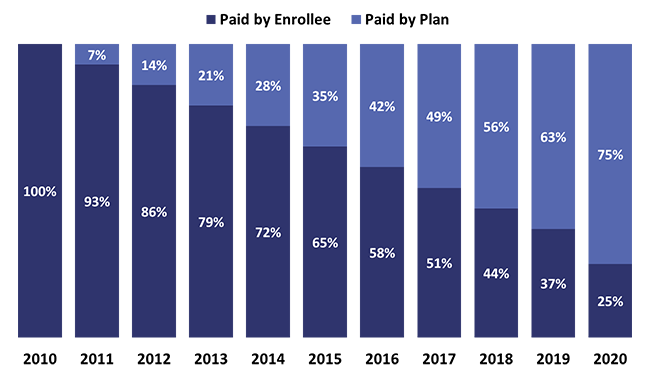

- Financial ruin. The money spent on soda pop might as well be money flushed down the toilet. Worse yet, for those whose health has been damaged by the consumption of pop, there are increased medical costs that somebody is paying for. I have heard many people anguishing over the copays for their insulins (especially when packaged in pens) such as Lantus, Humalog and Novolog. Additionally, major pharmaceutical companies have developed expensive new diabetic drugs such as Januvia, Victoza, Onglyza, Byetta, and Trajenta. The costs for some of these are so high that some people simply cannot afford them.

- Depression caused by a combination of the above occurrences.

I think Dr. Lustig would whole-heartedly agree that the drinking of soda pop may give temporary pleasure, but not only does it not lead to long-term happiness, but it contributes to depression when the negative results begin to occur. Please remember that too much pleasure leads to addiction and not enough happiness leads to depression.

Continuing:

Chapter 2: Looking for Love in all the Wrong Places

I thought Chapter 1 was a little on the technical side, but Chapter 2 is even worse. Lustig delves into the physiology of how the reward pathways work in our brains. For details, please read pages 26-32. He summarizes his commentary by stating:

These three pathways generate virtually all human emotion, and in particular, those of reward and contentment.

Because of how dopamine works on the reward pathways, virtually any stimulus that generates reward can lead to addiction. These addictions can include drug addiction, but they can also include behavior such as gambling or internet use. Sugar along with high fructose corn syrup sweetened foods or beverages are also highly addictive.

Happiness depends on serotonin, but the brain’s interpretation of these signals isn’t as simple as the pleasure signal.

Lustig explains that when the THC in marijuana binds to our CBI receptors it heightens mood and alleviates anxiety, which is partially why people become so giddy when they smoke pot…in those who toke, anxiety is thrown to the wind, leaving plenty of room for pleasure.

He discusses the drug Rimonabant which suppresses pleasure receptors. This drug was supposed to help people curb their eating as they received less pleasure from eating. The only problem was that when a person loses motivation for reward, he/she also lost motivation for life. Some suicides were the end result.

No pleasure means no happiness. Pleasure is the straw that stirs the drink. Happiness is the drink. Anxiety melts the ice cubes. We all need reward, because reward keep anxiety at bay . . . for a short time.

Lustig discusses the reward-contentment paradigm in relationships. Infatuation is the spark that may start a relationship, but for the long-term run, here is what he says:

Studies of married people show that the contentment derived from the commitment of an interpersonal union generates added individual benefit; people within such unions tend to live longer and develop fewer diseases then those who never married or those that are previously divorced.

Lustig points out that romance novels run on infatuation (reward) while love (contentment) is boring. Infatuation leads to alteration in the brain chemistry that resembles drug addiction, almost assuredly due to dopamine.

He concludes Chapter 2 by mentioning how the neurotransmitters dopamine and serotonin physiologically work in our brains. He explains that these two pathways influence each other.

When taken to the extreme, these two pathways can take you to the highest mountain or the lowest valley—addiction, depression, and just plain misery. The science in Part 2 and 3 says so.

End

Note from Lance: This is a reprint of an article by Dr. Sears with my comments after.

Note from Lance: This is a reprint of an article by Dr. Sears with my comments after. transcribed by Liz Reedy

transcribed by Liz Reedy by Ron Iverson, President of the National Association of Medicare Supplement and Medicare Advantage Producers. Inc. and Lance D. Reedy

by Ron Iverson, President of the National Association of Medicare Supplement and Medicare Advantage Producers. Inc. and Lance D. Reedy By Lance D. Reedy

By Lance D. Reedy Note: This is a reprint of an article we originally published in October 2015.

Note: This is a reprint of an article we originally published in October 2015.

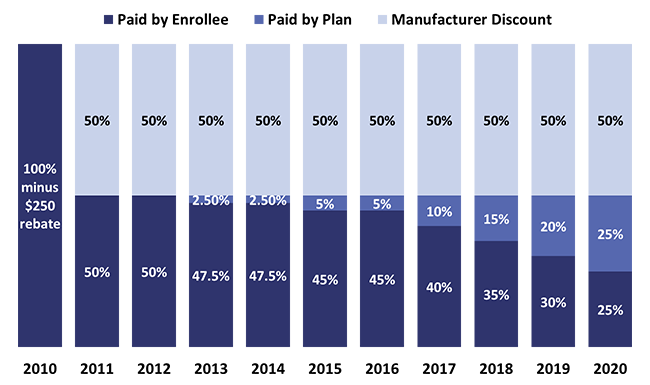

What is meant by the annual cost, annual spend, or estimated annual cost when we do a prescription drug plan (PDP) search on your behalf on Medicare.gov?

What is meant by the annual cost, annual spend, or estimated annual cost when we do a prescription drug plan (PDP) search on your behalf on Medicare.gov? Annual Election Period (AEP)

Annual Election Period (AEP) Just yesterday (as I write) I returned a call to one of my Blue Cross Blue Shield (BCBS) of Montana clients in Kalispell. I’ll assign him a fictitious name of Roger Jones. He told me that another agent from Acme Health Insurance called him to interest him in a Medicare advantage plan sponsored by Acme Health & Life. Acme is a large national insurance company that is spending a fortune in TV and direct mail advertising.

Just yesterday (as I write) I returned a call to one of my Blue Cross Blue Shield (BCBS) of Montana clients in Kalispell. I’ll assign him a fictitious name of Roger Jones. He told me that another agent from Acme Health Insurance called him to interest him in a Medicare advantage plan sponsored by Acme Health & Life. Acme is a large national insurance company that is spending a fortune in TV and direct mail advertising.